BSE SENSEX Here is a summary of the latest conditions and what’s influencing the Sensex movement:

Index movement

Today’s Market Update – Sensex & Major Drivers

-

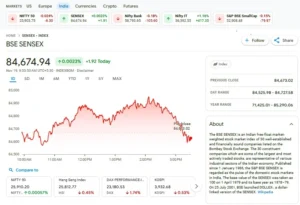

On Tuesday 18 Nov 2025, the Sensex broke its six-day winning streak, closing at 84,673.02, down 0.33%.

-

The broader regime: The Nifty 50 similarly closed at ~25,910.05, down about 0.40%

-

Market sentiment was cautious due to global cues, especially around interest-rate expectations in the U.S., a firmer dollar, and weak tech & metal sector performance.

Sectoral/stock-specific highlights

-

IT and metal stocks were among the top drags. For instance, companies like Infosys and a few in tech fell ~1%-2%.

-

Among the Sensex constituents, losers included Tech Mahindra, Infosys, Bajaj Finserv, etc. Gainers included Bharti Airtel, Axis Bank, Asian Paints, Titan.

-

In the broader market, MidCap and SmallCap indices also declined (~0.6% and ~1.05% respectively) on broader risk-off sentiment.

Key influencing factors

Key influencing factors

-

Global cues & interest rates: Investor caution increased as expectations of a U.S. Federal Reserve rate cut weakened, which tends to cause capital outflows from emerging markets like India.

-

Weekly expiry & volatility: The session coincided with the weekly futures & options expiry of the Nifty, adding to volatility and cautious positioning.

-

Domestic earnings & policy support: The recently previous sessions had seen optimism due to RBI relief measures for exporters and strong Q2 earnings expectations, which had propelled prior gains.BSE SENSEX

-

Exchange rates & commodity prices: A stronger dollar and weak base-metal prices weighed on metal stocks; crude oil movements also influenced energy/industrial shares.BSE SENSEX

Outlook for the near term

-

Analysts suggest that key support zones for Sensex lie around 84,500 – 84,300, while immediate resistance is seen in the 85,000 – 85,300 range. A decisive break below support could lead to greater weakness, though the medium-term trend is still viewed as positive

-

If global risk-sentiment improves, or domestic corporate earnings beat expectations, the Sensex may attempt to recover and test the higher resistance levels.BSE SENSEX

Structural Drivers & Long-Term View

While daily fluctuations are driven by short-term factors, there are several structural drivers that underpin the sensex’s medium to long-term outlook:

1. India’s economic growth trajectory

India continues to be one of the fastest-growing major economies, with favourable demographics, increasing consumption, urbanisation and infrastructure investment. This helps support corporate earnings and investor interest.

2. Rising foreign investor interest

With valuations in U.S. tech and China facing pressure, global investors are looking at India as a diversification play. HSBC’s target of 94,000 by end-2026 reflects this narrative.

3. Corporate earnings momentum

Large-cap Indian companies, many of which are Sensex constituents, have been showing improving profitability and return on equity, aided by structural reforms, cost rationalisations and market expansion.

4. Reform & policy support

Government initiatives such as infrastructure spending, privatisation, support for manufacturing (via “Make in India”), and financial sector reforms provide a supportive backdrop for equity markets.

5. Digital/tech & consumption themes

India’s rapid digitisation, rising internet penetration, and growing middle class all provide growth tailwinds for sectors such as tech, consumer, fintech etc., which in turn impact many Sensex stocks.

Risks & Caution-Areas

No market is without risk. For the Sensex these include:

-

Global macro risk: A sudden shift in global growth, inflation or geopolitical tensions can lead to investor flight from emerging markets.BSE SENSEX

-

Valuation risk: With large-cap stocks having already rallied, potential for “valuation fatigue” exists if earnings don’t keep pace.

-

Policy/regulation risk: Any major regulatory surprise (eg, banking/financial sector, tax changes) can impact market mood.

-

Domestic slowdown: If India’s growth momentum falters (due to inflation, fiscal slippages, etc), corporate earnings may get impacted.BSE SENSEX

-

Sectoral concentration/reversal: Large-cap indices like Sensex are tilted towards certain sectors; a rotation away from those sectors may drag the index even if segment-specific stocks do well.BSE SENSEX

What Should Investors Do?

Here are some practical takeaways for investors following the Sensex:

-

Monitor the index levels: Since Sensex has defined support/resistance zones currently (ie ~84,300 support, ~85,000 resistance as of now), investors can use these for sentiment cues.

-

Watch sectoral leadership: Which sectors are leading? For example, financials and exporters had been strong; recently tech/metal have been weak.BSE SENSEX

-

Be mindful of global cues: Since global factors (Fed policy, dollar, commodities) heavily influence market mood, staying abreast of those is important.

-

Use a balanced approach: While the medium-term is positive, the near term may be volatile—so diversification, careful stock selection, and risk management matter.

-

Focus on large-cap strength with earnings backing: Sensex constituents are large-cap companies; picking well-managed firms with earnings growth can help navigate turbulence

FOR MORE INFO CLICK TO START BUTTON