The stock market is a financial marketplace where investors buy and sell shares (equities) of publicly traded companies. These shares represent partial ownership in the company. When a company does well, its share price typically rises, benefiting shareholders; when performance falters, prices fall.

There are several major stock exchanges around the world, such as the New York Stock Exchange (NYSE), Nasdaq, the Bombay Stock Exchange (BSE), and the National Stock Exchange (NSE) in India. The performance of the stock market is often used as a barometer of a country’s economic health.

Why the Stock Market Matters

-

Wealth Creation: Many investors use equities to build long-term wealth. Historically, stocks have offered higher returns than many other asset classes.

-

Capital for Companies: When companies issue shares, they raise capital for expansion, research, and growth.

-

Economic Indicator: Rising markets often reflect economic optimism; falling markets may hint at trouble ahead.

-

Liquidity: Stocks can be bought and sold relatively easily compared to other investments like real estate.

-

Diversification: Investors can spread risk by holding shares across sectors and geographies.

Key Players in the Stock Market

-

Retail Investors: Individual investors who buy and sell shares for personal investment.

-

Institutional Investors: Entities like mutual funds, pension funds, and hedge funds that trade in large volumes.

-

Brokerages: Firms that facilitate buying and selling of stocks; they earn through commissions or transaction fees.

-

Regulators: Organizations such as the Securities and Exchange Board of India (SEBI) in India, or SEC in the U.S., which oversee trading and protect investors.

How Stock Prices Move

Several factors influence stock prices:

-

Company Fundamentals: Earnings, debt levels, growth potential.

-

Economic Data: GDP growth, unemployment rate, inflation.

-

Global Events: Geopolitical tensions, trade deals, and global economic crises.

-

Monetary Policy: Interest rates set by central banks (e.g., RBI, Fed) can strongly influence markets.

-

Investor Sentiment: Market psychology, fear & greed.

-

Technological Trends: Disruptive innovations (like AI) can boost or hurt specific industries.

Types of Stock Market Investments

-

Blue-chip Stocks: Shares of large, well-established companies (e.g., Reliance, Infosys).

-

Mid-cap & Small-cap Stocks: Companies with smaller market capitalizations; potentially high growth, but riskier.

-

Growth Stocks: Focus on future growth rather than current profits (often tech).

-

Value Stocks: Undervalued companies trading for less than their intrinsic worth.

-

Dividend Stocks: Companies that pay regular dividends; good for income-focused investors.

-

ETFs & Mutual Funds: Pooled investment vehicles that hold baskets of stocks.

Risks in the Stock Market

-

Volatility: Prices can swing widely in short periods.

-

Market Risk: Economic downturns or systemic shocks can drive losses.

-

Liquidity Risk: In less-traded stocks, it may be hard to sell without affecting price.

-

Company Risk: Poor management or business failure.

-

Regulatory Risk: Changes in laws or regulations can impact profitability.

How to Invest Wisely

-

Set Clear Goals: Decide whether you’re investing for long-term growth, income, or short-term gains.

-

Do Fundamental Analysis: Study financial reports, balance sheets, and earnings.

-

Use Technical Analysis: For short-term trading, charts, volume, and indicators (like RSI or MACD) can help.

-

Diversify: Don’t put all your money in one stock or sector.

-

Stay Informed: Follow market news, economic data, and corporate earnings.

-

Have an Exit Strategy: Know when you’ll sell, whether to take profits or cut losses.

-

Use Stop-Loss Orders: Protect yourself from big downturns by setting automatic sell triggers.

-

Consider Professional Help: Financial advisors or robo-advisors can guide investing.

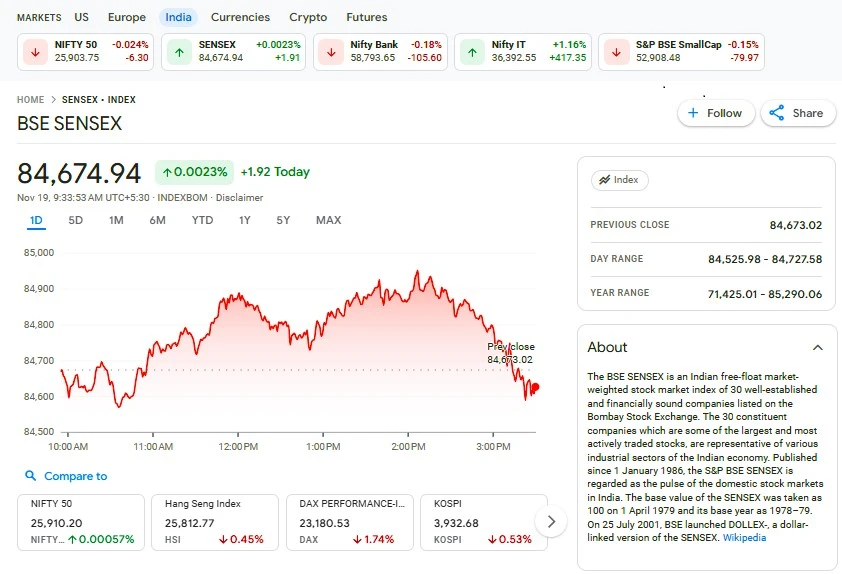

Today’s Stock Market Update (India + Global)

Here’s a rundown of the latest stock market update, covering India and global markets, based on the most recent news:

Indian Market (Domestic Update)

-

The Nifty50 and BSE Sensex snapped a six-day winning streak. On November 18, 2025, both indices closed in the red amid broad-based selling, especially in the IT, metals, and capital goods sectors. According to Moneycontrol, the Nifty50 fell to around 25,910 points, down about 103 points on the day.

-

Over 120 stocks touched their 52-week high on the BSE during the session, signaling pockets of strength even as the broader market declined.

-

The market decline was attributed to weak global cues.

-

On the flip side, in a recent session before this drop, the Sensex had rallied 388 points, and the Nifty crossed the 26,000 mark, driven by financial stock strength and supportive measures from the Reserve Bank of India.

-

In that same session, market capitalization of BSE-listed companies rose significantly, reflecting strong investor confidence.

Global Market Factors

-

Asian markets are showing caution ahead of Nvidia’s earnings report. Nvidia is considered central to recent AI-driven market rallies.

-

Concerns around inflated valuations in AI stocks are starting to weigh on investor sentiment globally.

-

In Europe, the FTSE 100 saw its biggest drop since April, driven by fears of overvaluation in technology and AI stocks.

-

The possibility of a U.S. interest rate cut has become less certain, adding to global volatility.

-

AI Valuation Anxiety: With companies like Nvidia at the center, investors are increasingly worried about a potential AI bubble.

-

Global Risk Appetite: Weakness in global markets is filtering into Indian equities, prompting sell-offs.

-

Domestic Support Measures: Relief from RBI for exporters has bolstered some financials, though it’s not enough to offset global concerns stock market

-

Rotation in Sectors: While some sectors are weak (IT, metals), there’s strength in financials and other cyclical plays

What Investors Should Watch Going Forward

-

Nvidia Earnings: This is a big moment — the results could either validate or shake up current AI valuations.

-

Interest Rate Moves: Keep an eye on Fed (U.S.) and RBI (India) policies. Any change could shift flow of capital.

-

Global Economic Data: Inflation, GDP growth, and trade data will continue to influence markets.

-

Corporate Earnings: Indian companies’ Q2 earnings season will be closely watched, especially in key sectors like IT, financials, and capital goods.

-

Foreign Institutional Investor (FII) Flows: If global markets decline, FIIs may reduce exposure to Indian markets, leading to further volatility.

-

Investor Sentiment: Market psychology is fragile; a shock could trigger swift reversals.

How to Navigate the Current Market

Given the mixed signals in the market:

-

Be Selective: Don’t just buy index — pick high-conviction stocks or sectors.stock market

-

Hedge Risks: Use stop-loss orders, or consider hedging strategies if you’re worried about further volatility.

-

Stay Liquid: Keep some cash handy to take advantage of potential dips.

-

Track Global Trends: Pay close attention to Nvidia and other tech earnings, as well as central bank actions.

-

Long-Term Mindset: For long-term investors, this could be a good time to accumulate fundamentally strong companies at better valuations.

Conclusion

The stock market continues to be one of the most dynamic arenas for investing. While long-term investors view it as a powerful tool for wealth creation, the daily swings remind us that risk is ever-present. Today’s market update reflects the tension: on one side, domestic strength fueled by policy support; on the other, global headwinds fueled by uncertainty in tech and AI valuations.

In this volatile environment, investors who stay informed, stay diversified, and think strategically are likely to be better positioned to navigate both the risks and opportunities. Whether you’re investing for the long haul or trading more actively, keeping an eye on global developments, corporate earnings, and central bank moves will be key.stock market